Overtime pay calculator after taxes

Overtime tax calculator Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. The overtime calculator uses the following formulae.

Salary Increase Template Excel Compensation Metrics Calculations Salary Increase Business Budget Template Excel Budget Template

Calculating Annual Salary Using Bi-Weekly Gross.

. In addition a rate of nothing is included for people who. Generate your paystubs online in a few steps and have them emailed to you right away. If you estimate that your Louisiana state tax liability after credits and other income taxes are withheld will exceed 1000 for single filers or 2000 for joint filers you must make whats.

It can also be used to help fill steps 3. Then determine your gross pay for the period. Your employer will withhold money from each of.

Our 2022 GS Pay. For example for 5 hours a month at time and a half enter 5 15. Overtime tax calculator Using.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Ad Compare 5 Best Payroll Services Find the Best Rates. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Discover the Best Employee Time Calculator Tools of 2022 - Start your Search Now. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Annual Salary Bi-Weekly Gross 14 days.

Make Your Payroll Effortless and Focus on What really Matters. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Welcome to the FederalPay GS Pay Calculator. Ad Create professional looking paystubs. 14 days in a bi-weekly pay period.

Our 2022 GS Pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To do this you multiply your.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The calculator includes rates for regular time and overtime. The simplest way to work out how much.

Enter the number of hours and the rate at which you will get paid. First calculate your overtime rate. Overtime pay calculator after taxes Selasa 13 September 2022 Edit.

Pay rates include straight time time and a half double time and triple time. We use the most recent and accurate information. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

365 days in the year please use 366 for leap years Formula. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. In most situations this is one-and-a-half times your hourly wage.

In the Weekly hours field enter the number of hours you do each week excluding any overtime. Multiply the number of hours worked by the difference in the hourly pay rate Multiply the 80 hours earned by the 2 difference to get the retroactive pay total. Get an accurate picture of the employees gross pay.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. If you do any overtime enter the number of hours you do each month and the rate you get paid at. There are two options in case you have two different.

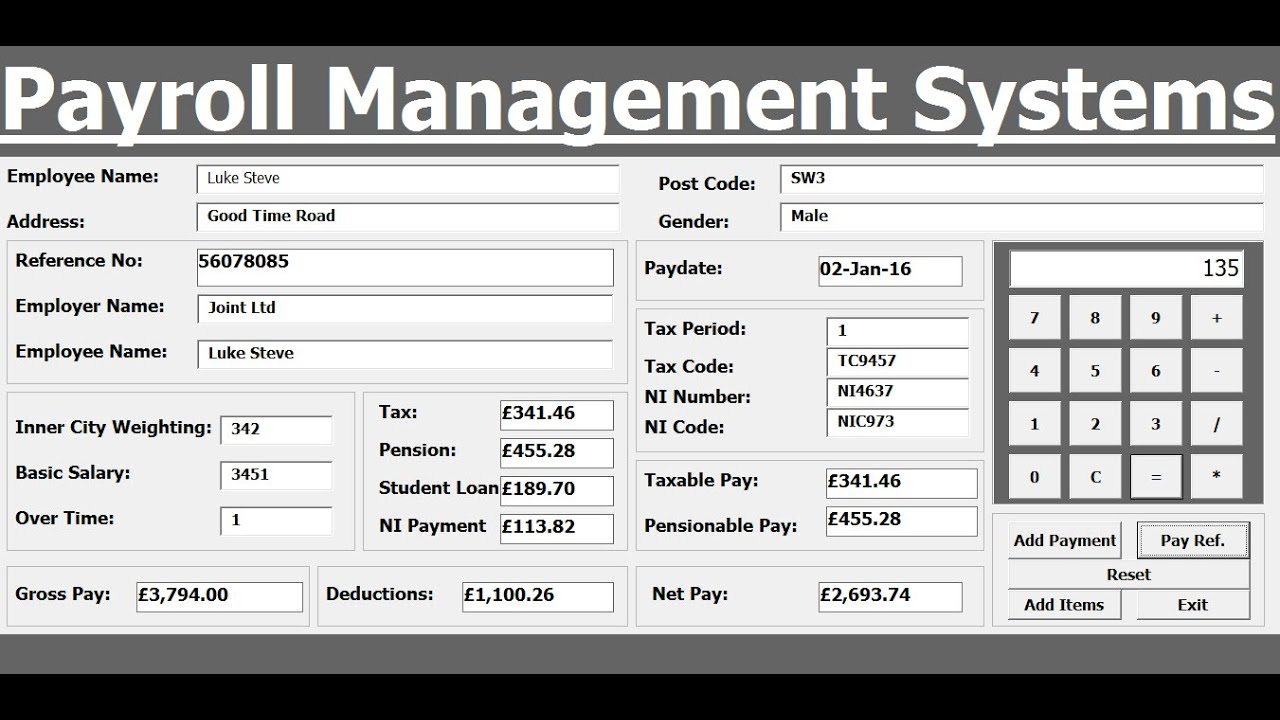

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Taxi Services Receipt Template Illustrator Indesign Word Apple Pages Psd Publisher Template Net Receipt Template Templates Taxi Service

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates

Bookkeeping Templates Payroll Payroll Template

Accounting Worksheet Template Double Entry Bookkeeping Bookkeeping Templates Worksheet Template Spreadsheet Template

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Salary Slip Templates 20 Ms Word Excel Formats Samples Forms Payroll Template Invoice Template Word Money Template

Free 40 Cost Benefit Analysis Templates Amp Amp Examples Templatelab Cost And Benefit Spreadsheet Template Analysis Business Impact

Award Winning Cloud Based Hr Payroll Software In Singapore Video Payroll Software Hospitality Design Hrms

Pin On Ideas

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

Template Net Price Quotation Template 9 Free Sample Example Format Download 4ef698d9 Resumesample Resumefor Technology Quotes Quotations Excel Templates

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates